Technology is transforming the automotive industry as governments worldwide increasingly encourage — through subsidies, taxes and regulation — the adoption of electric vehicles to lower climate pollution and fossil fuel use. In addition, rapid advances in artificial intelligence and consumer demand for safer, more convenient cars and trucks have led automakers and suppliers to develop autonomous driving capabilities and software-based vehicle architectures.

As a result, modern vehicles are becoming more like smartphones on wheels, with the ability to receive over-the-air software updates and deliver a hands-free driving experience on highways.

With technology evolving quickly, automakers must adapt to a changing industry while meeting their customers’ needs and expectations. Here are some of the trends poised to reshape the auto industry.

EVs will streamline manufacturing, but labor and supply chain issues loom

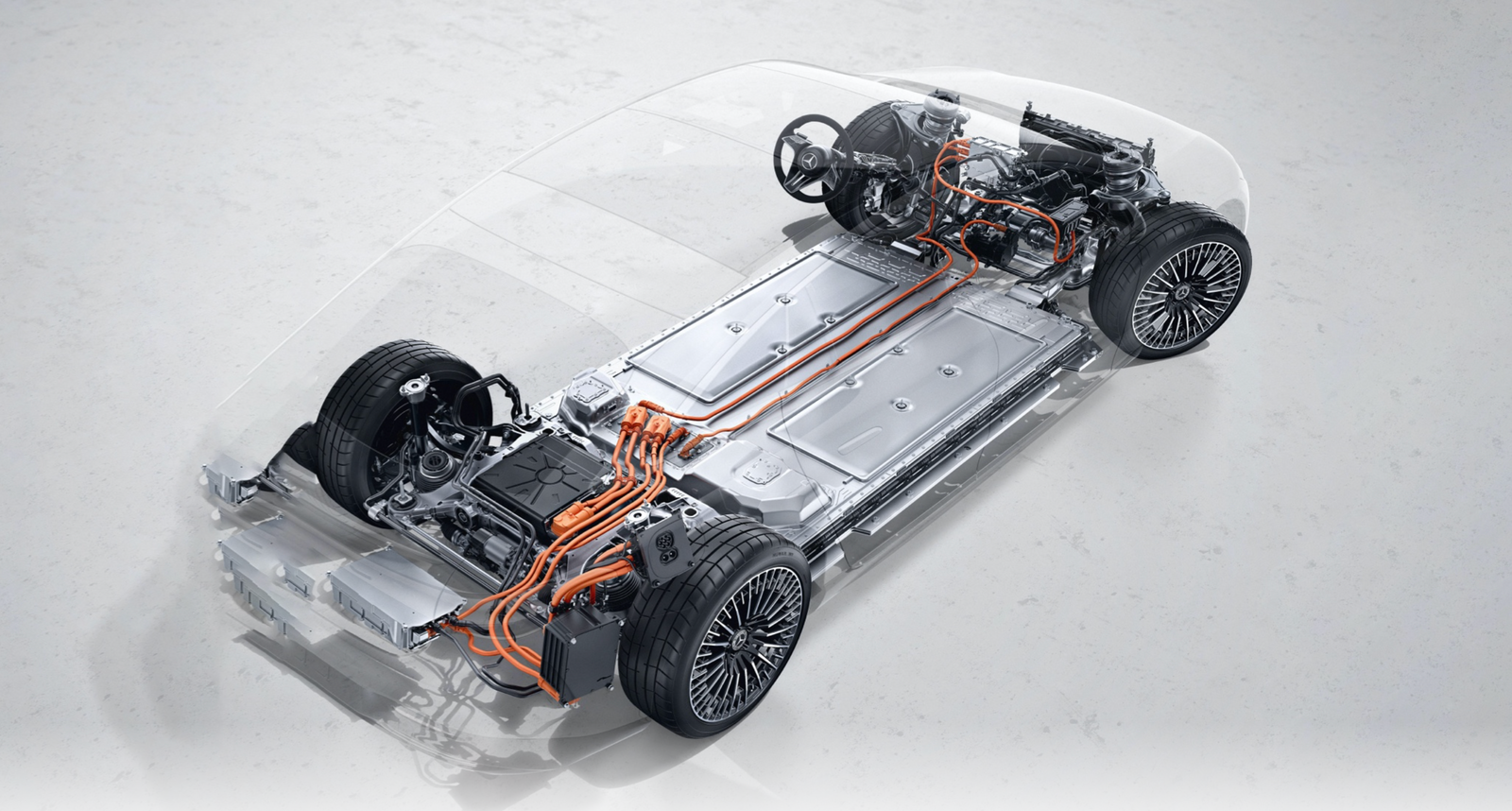

With many fewer parts than traditional cars and trucks, EVs will eventually become simpler for automakers to manufacture than vehicles with internal combustion engines, which could drive down production costs.

In addition, the components are highly modular, making it easier to share them among different models. Add in robotics, and assembly lines will only grow more efficient with time and technology, likely requiring fewer workers to assemble future EVs.

According to a 2021 report by the Economic Policy Institute, a 50% increase in domestic EV auto sales by 2030 could eliminate roughly 75,000 auto industry jobs. The EV transition has already rankled the United Auto Workers, setting up a potential showdown with automakers if the industry begins hemorrhaging manufacturing jobs.

In addition to job loss concerns, automakers must establish new supply chains and revamp their long-standing supplier networks to build EVs. Over the next decade, many components produced by tier 1 suppliers, such as exhaust systems and engine oil filters, will become obsolete. Other major components, such as engine blocks, cylinder heads and automatic transmission assemblies, are also not required for EVs, so automakers will significantly scale back their production in the coming years.

Domestic EV battery and semiconductor market heat up

With the Biden administration's push to make America energy-independent, billions of dollars are reserved to establish production capacity and supply chains for EV batteries and electronics in the U.S.

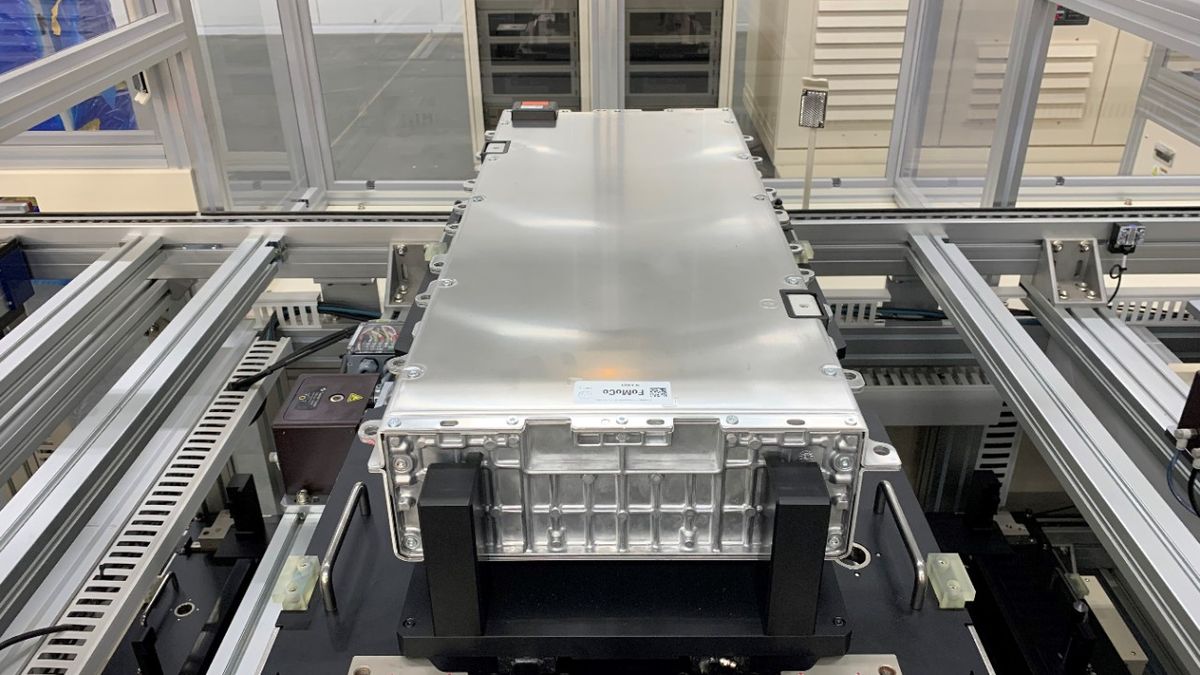

GM is in the early stages of building a domestic supply chain for EV batteries, with three U.S. factories currently under construction. The automaker formed a joint venture with LG Chem last year to produce enough batteries to power around 1 million vehicles by 2025.

Ford will also assemble batteries in the U.S. through its joint venture with SK Innovation. The two companies are investing $5.8 billion to build a battery factory in Glendale, Kentucky.

In addition to batteries, the recent semiconductor shortage showed the importance of having a domestic supply chain for the electronic parts needed to manufacture EVs, as automakers faced production shutdowns that led to vehicle shortages, extended customer wait times and a lack of vehicle inventory at dealerships.

Many automakers, including Tesla, rely on a network of Asian suppliers for batteries and other electrical components. But ongoing trade and political tensions between China and the U.S., including new restrictions on semiconductor sales, have alarmed the industry, according to a February 2023 Atlantic Council report on the semiconductor supply chain.

Congress designed the 2022 bipartisan CHIPS and Science Act to boost domestic semiconductor research, development and production, aiming to bolster U.S. leadership in semiconductor manufacturing — many appliances, small electronics and other products use semiconductors.

The legislation provides $52.7 billion for American semiconductor research, development, manufacturing and workforce development. This figure includes $39 billion in manufacturing incentives, including $2 billion for legacy chips used in automobiles.

New battery chemistries aim to reduce costs and improve safety

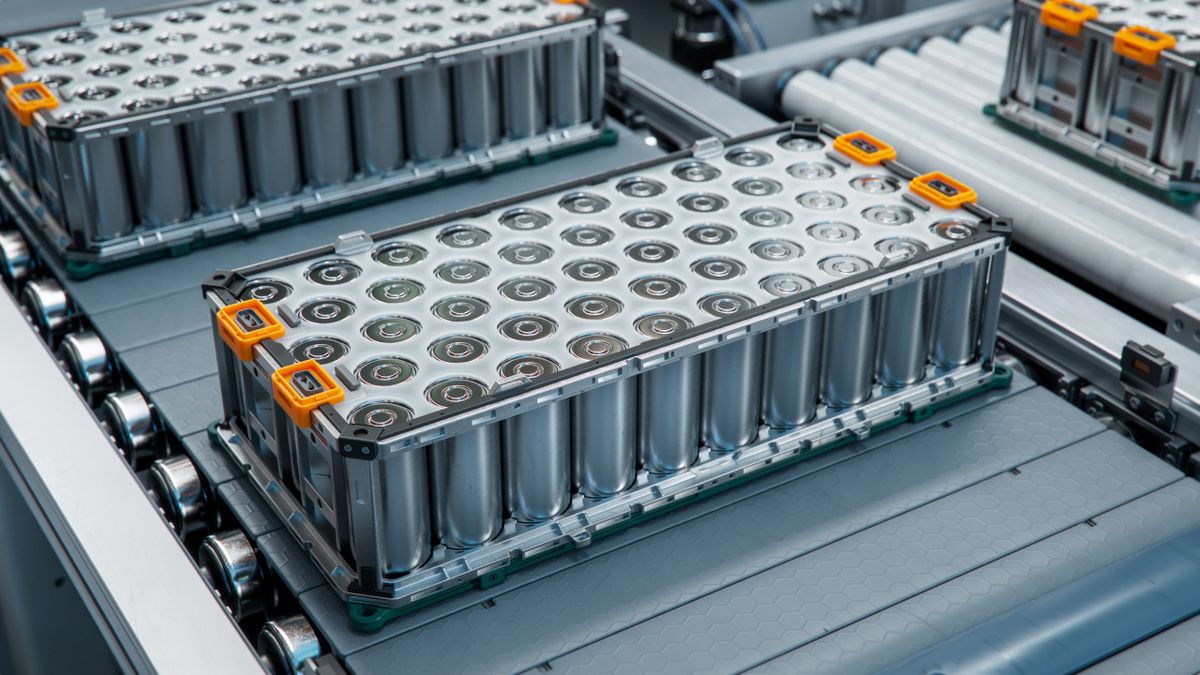

The high cost of cobalt, used in nickel-manganese-cobalt batteries, has caused automakers to explore alternative battery chemistries, with three contenders leading the pack.

- Lithium nickel cobalt aluminum oxide batteries use aluminum as a replacement for some amount of cobalt, making them less expensive to produce. These batteries offer a reasonable balance of energy density, power and durability. The trade-off, however, is that NCA batteries have slightly lower energy density than similarly sized NMC batteries, which lowers range. Tesla currently uses them in its Model 3 and Model Y Performance versions.

- Lithium iron phosphate batteries are gaining popularity with automakers because they cost less to produce and have a longer lifespan than NMC batteries. With lower costs, manufacturers can use more of them in a battery pack to extend range. LFP batteries also use iron phosphate for the positively charged cathodes instead of lithium and aluminum, making them more environmentally friendly than other chemistries. LFP batteries also have more stable chemistry, even at temperatures up to 500 degrees Celsius, reducing the chance of battery fires compared with NMC batteries. The Long Range and Standard Range Plus versions of the Tesla Model 3 and Model Y use LFP batteries.

- Sodium-ion batteries, currently in the early stages of development, use sodium, which can be easily extracted from abundant seawater instead of mining for metals, as a replacement for lithium. These batteries do not contain cobalt or nickel but have lower energy density and take more time to charge than existing EV batteries.

Level 3 autonomous driving systems will hit U.S. roads, but regulations will stall growth

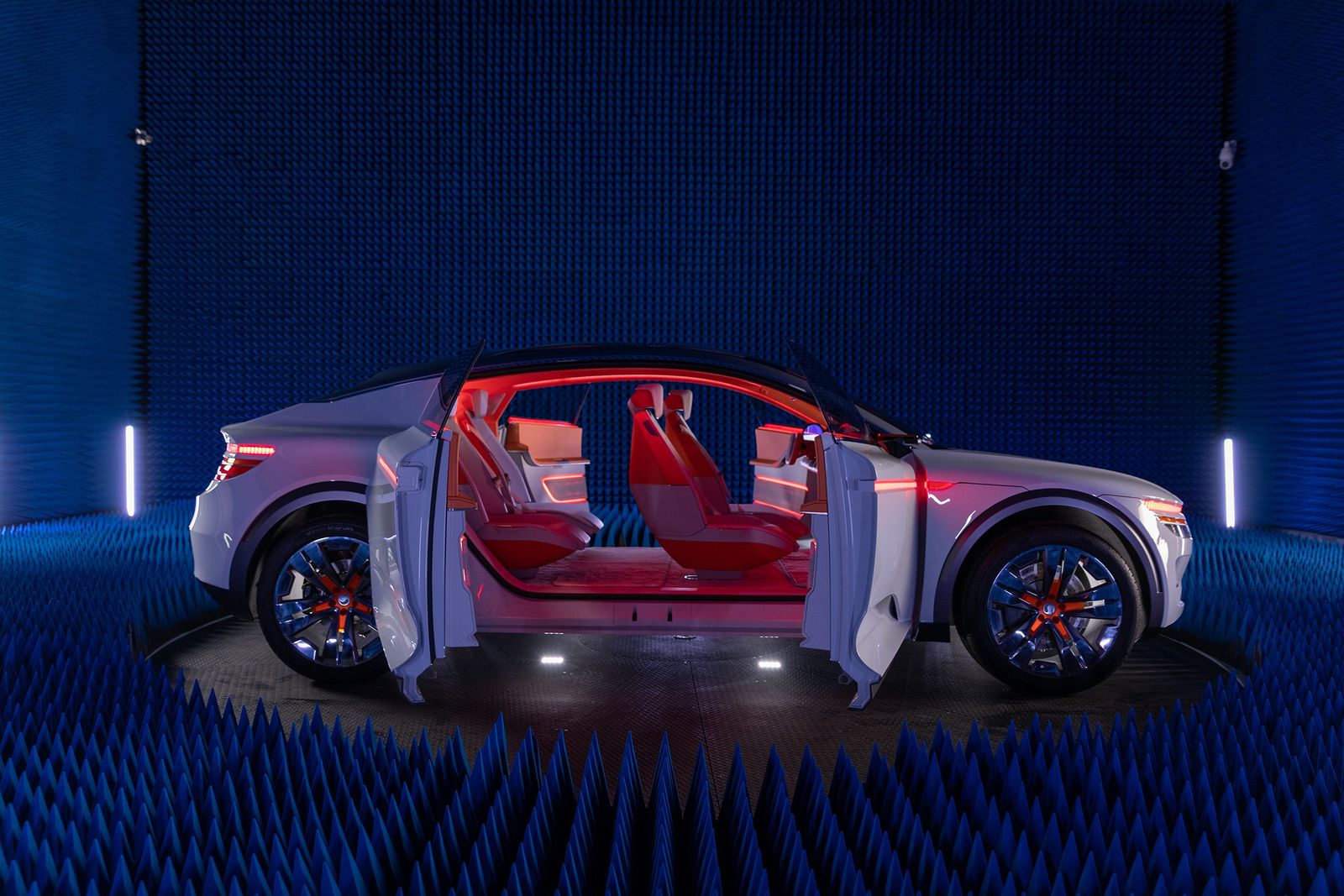

While several autonomous driving features, such as Tesla's Autopilot, General Motors’ Super Cruise and Ford’s Blue Cruise, are on the market already, these advanced driver assist systems are not self-driving capable. In the pipeline, however, are Level 3 systems, which allow drivers to read books or check email but still require them to be ready to take over if prompted.

In December 2021, Mercedes-Benz became the first automaker to meet the international legal requirements for a Level 3 system with its Drive Pilot system, offered on the 2023 S-Class and EQS sedan.

Currently, Drive Pilot uses LiDAR, camera, radar and ultrasonic sensors to support highly automated driving at speeds under 40 mph, which is ideal for navigating in slow-moving, stop-and-go traffic. But support for higher speeds will likely be ready soon. Mercedes-Benz is focusing on offering automated driving at speeds of up to 80 mph.

Drive Pilot is currently available in Germany, but earlier this year, Nevada became the first state in the U.S. to approve the operation of Level 3 autonomous driving systems on select public roads. Mercedes-Benz also recently gained conditional approval to offer the technology in California.

However, before SAE Level 3 and higher systems appear elsewhere on public roads, governments must establish regulations governing their use, which could take years. Another concern is liability if something goes wrong while these autonomous systems are active.

Connected vehicles bring convenience, as well as cyber risks

In the years to come, drivers will be able to pay to recharge or for a meal at a drive-thru through their vehicle’s infotainment screen as connected vehicles make their way on the roads.

According to a 2022 report by Statista, the number of connected vehicles in the U.S. is expected to top 150 million by 2025, up from 84 million today. By 2035, that figure could top 300 million, making the U.S. the world's biggest market for connected cars.

This technology also allows companies to use highly accurate location data and in-vehicle apps to market and advertise to consumers while they drive. Car dealers can also use the technology for remote diagnostics and maintenance tracking.

Cellular vehicle-to-everything technology being developed by companies such as Qualcomm Technologies will also allow connected vehicles to “talk to each other” and communicate with nearby infrastructure, such as traffic signals, which could help reduce traffic congestion, improve road safety and lower emissions. These communication technologies include vehicle-to-vehicle, vehicle-to-infrastructure, vehicle-to-pedestrian and vehicle-to-cloud communications.

But with these new technologies comes security risks. Sending data to and from connected vehicles will require automakers to adopt more robust cybersecurity technology to protect sensitive data, leading companies like Aptiv to develop new vehicle architectures that can help prevent cyberattacks.

Vehicle software subscriptions yield new revenue streams

As automakers transition to building software-defined vehicles, subscriptions that unlock vehicle upgrades, such as increasing performance and acceleration and customizing dashboard displays, create new revenue opportunities. For EVs, drivers may be able to unlock additional range for a small fee when planning a long road trip to minimize charging stops.

Mercedes-Benz offers a subscription model called “Acceleration Increase” for its EQ lineup of electric vehicles that unlocks a performance boost. Subscribers gain access to quicker acceleration and greater torque and maximum output.

Other automakers are likely to follow with their own vehicle subscription models. But some car buyers are not thrilled about some automaker subscription models.

BMW, for example, was ridiculed by its European customers after asking them to pay a monthly fee for activating a heated front seat option, even though the seat heaters were pre-installed at the factory. Still, this initial pushback from drivers probably won’t stop automakers from adopting subscription models in the future.

In the U.S., BMW offers a variety of subscription plans via its “Connected Drive” online store, such as a heated front seat subscription for $29 a month. Adding a heated steering wheel feature costs $19 a month. The company also offers, for 29$ a month, an autonomous parking feature called “Parking Assistant Professional” that makes it easier for customers to park their vehicles.

New hardware partnerships with automakers

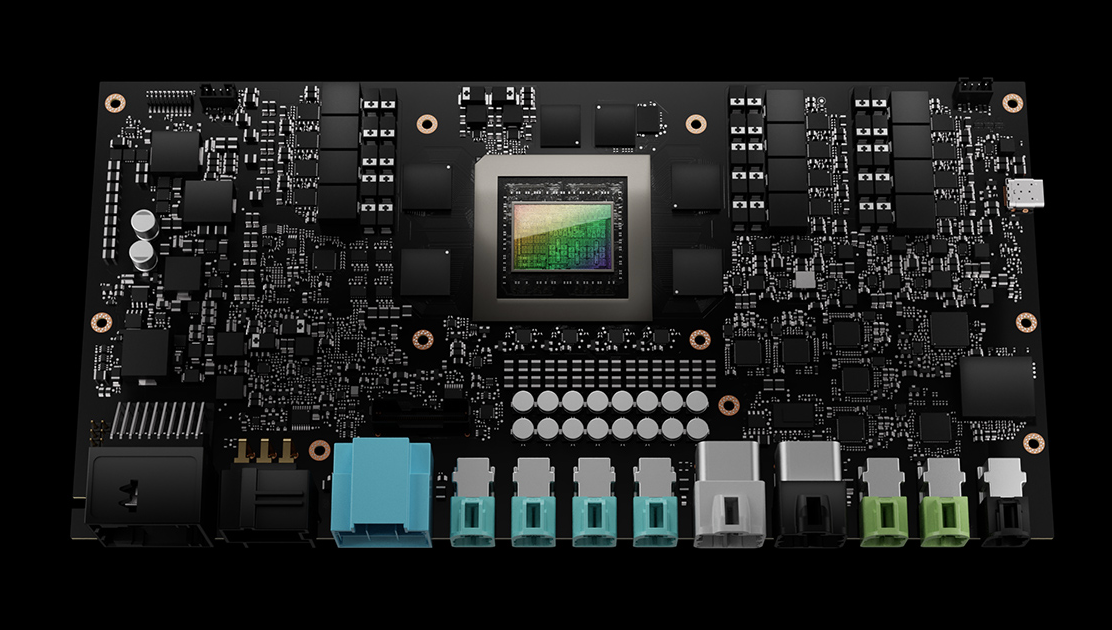

Automakers are turning to technology companies like Nvidia and Qualcomm to supply the hardware for the next generation of connected and software-based EVs.

Ten years ago, seeing Nvidia’s push into the automotive space would have been surprising. But now the tech company is at the center of a growing market for advanced AI-powered processors for the auto industry, which support features such as autonomous driving and other advanced vehicle safety systems.

Automakers using Nvidia’s hardware include Mercedes-Benz, Lucid, Volvo, Land Rover, Hyundai, Kia and BYD. EV pioneer Tesla once counted on Nvidia for the processors in its vehicles, but the company has since designed its own processor.

Over the last few years, Qualcomm has also signed multiple agreements with car manufacturers to provide hardware platforms for connected and automated cars, including Stellantis, Mercedes-Benz, Honda and Renault.

Partnerships with suppliers traditionally outside of the automotive industry are likely to grow substantially as electronics replace many of the mechanical systems found in ICE vehicles. According to an Ernst and Young report, as car makers sign these agreements, they must consider how to negotiate the partnership structures and design a governance model.

“Partnerships with technology firms are the optimal strategy to gain quick access to critical technologies and capabilities, but these arrangements must be designed to support the product integration agenda and enhance the customer experience throughout the product life cycle,” the report says. “By properly structuring and operationalizing these partnerships, leading auto companies will position themselves to thrive even as their industry continues its dizzying pace of change.”